by rtdosen | Oct 3, 2014 | Ryan Dosen Real Estate Articles

Top 5 Fall Home Care Tips By Ryan Dosen Summer has gone the way of the ghost, and now enters what I believe to be the most beautiful of all our seasons. Welcome are the cooler temperatures and the beautiful, colorful transformations of our landscape; but there is much to be done in addition to stimulating our senses. Fall is a pleasant prelude to the often disagreeable doings of the winter months. A little preparation now can save a lot of headaches in the future. So, let’s take a quick look at some of the things that should be on your fall to-do list. Repair Cracks We live in an area in which we can see several freezes and thaws during the winter months. These repeated freezes and thaws can destroy a driveway or walkway. Water and moisture seeps into a driveway’s small cracks when it rains or when snow and slush thaws. If the temp drops below freezing while those cracks are filled with water, the water will expand when it turns to ice. This expansion applies pressure and further damages your driveway. This fall, be sure that you clean out and repair any cracks with driveway filler and then coat the driveway with a commercial sealer. Clean Your Gutters and Downspouts After they fall, some of those beautifully-colored leaves can wind up clogging your home’s gutters and downspouts. Left unchecked, those clogged gutters can lead to damaged exterior surfaces, water in your basement, and super-sized ice dams. Ice dams are ridges of ice that build up along the edge of your roof, preventing melting ice...

by rtdosen | Sep 26, 2014 | Ryan Dosen Real Estate Articles

An Unexpected Surge in New Home Sales By Ryan Dosen The sale of new homes took a giant step forward to pre-recession levels in August. The rise in new home sales was well ahead of almost all experts’ expectations and it provides yet another good sign for our slowly improving real estate market. New home sales climb quickly The U.S. Commerce Department reported earlier this week that American new home sales rose an astounding 18 percent in August to an annualized pace of 504,000 units. This is the highest pace our housing market has seen since May of 2008. A Bloomberg survey of 74 economists produced a median forecast of a small increase to an annual rate of 430,000 units, with estimates ranging only as high as 455,000 units. Also interesting is the Commerce Department’s revelation that the median sales price of a new home climbed 8 percent from August 2013 to its current level of $275,600. Basically, more people are buying more expensive and nicer new homes. The loosening of America’s purse strings and willingness to take out loans to purchase nicer and more expensive homes speaks to increased consumer confidence, a key factor when monitoring the real estate market. As confidence rises, people generally buy more homes. Boost in consumer sentiment is a good housing indicator Improving consumer sentiment was confirmed earlier this week by the Preliminary University of Michigan Consumer Sentiment for September, which rose another 2.1 points to 84.6, the highest level since July of 2013. This month’s sentiment number also beat Investing.com’s forecast of 83.3. Doug Short of AdvisorPerspectives.com says that to...

by rtdosen | Sep 19, 2014 | Ryan Dosen Real Estate Articles

Home Refinancing’s Lesser Known Features and Benefits By Ryan Dosen If you’re a homeowner, now could be a good time to explore your refinancing options. This column has given a great deal of attention to the fact that we are still enjoying historically low interest rates that will not last forever (and probably not much longer). This is all great news if you are in the market to buy a home. You’re going to have the chance to lock in these amazing rates and enjoy the ride for the long haul. Whether you plan to stay in your current home or you’re looking to leave within the next year, there are ways to maximize savings by taking advantage of low rates—and more reasons to do so than you might have even considered. Median Household Would Save Big by Refinancing The National Bureau of Economic Research (NBER) recently studied a large, random sample of outstanding mortgages from December 2010 and discovered that the median household could save $160 per month over the remaining life of their loan by refinancing, amounting to a total savings of around $11,500. NBER says that their “results suggest the presence of information barriers regarding the potential benefits and costs of refinancing.” The Bureau called for “expanding and developing partnerships with certified housing counseling agencies to offer more targeted and in-depth workshops and counseling surrounding the refinancing decision…to alleviate these barriers .” Our Expert’s Take on Refinancing To do our part in breaking down the educational barriers related to refinancing, I spoke with Joe Gonzalez, a local mortgage expert with Gateway Funding in...

by rtdosen | Sep 12, 2014 | Ryan Dosen Real Estate Articles

The New American Majority of Single Adults and the Impact on Housing By Ryan Dosen The number of single American adults has been rising for years and singles now make up more than half of the American adult population for the first time ever. Depending on your perspective, this increasing tendency toward a more solitary existence could be a cause for concern or a positive sign of societal evolution. Regardless of viewpoint, the shift has been in the works for years and it is not likely to change course. All we can do is take a look at the implications of our new society, where it is now the norm to be alone, or shall we say, independent. Yardeni and Single America The Bureau of Labor Statistics says that in 1976 only 37.4 percent of Americans that were 16 years or older were single. The number of single Americans has been steadily climbing ever since, and now 124.6 million Americans, or 50.2 percent of Americans aged 16 years or older, are now single. This jump from about a third to more than half adult Americans being single signals an interesting and important change in the way our society should be viewed. Economist Edward Yardeni, president of Yardeni Research Inc., recently released a report entitled “Selfies,” calling the shift “remarkable.” Yardeni says that an increasingly single America has “implications for our economy, society and politics.” He says that singles, especially young singles, are more likely to rent and less likely to have children. Not having children obviously impacts how much money those individuals have to spend and on what...

by rtdosen | Sep 8, 2014 | Ryan Dosen Real Estate Articles

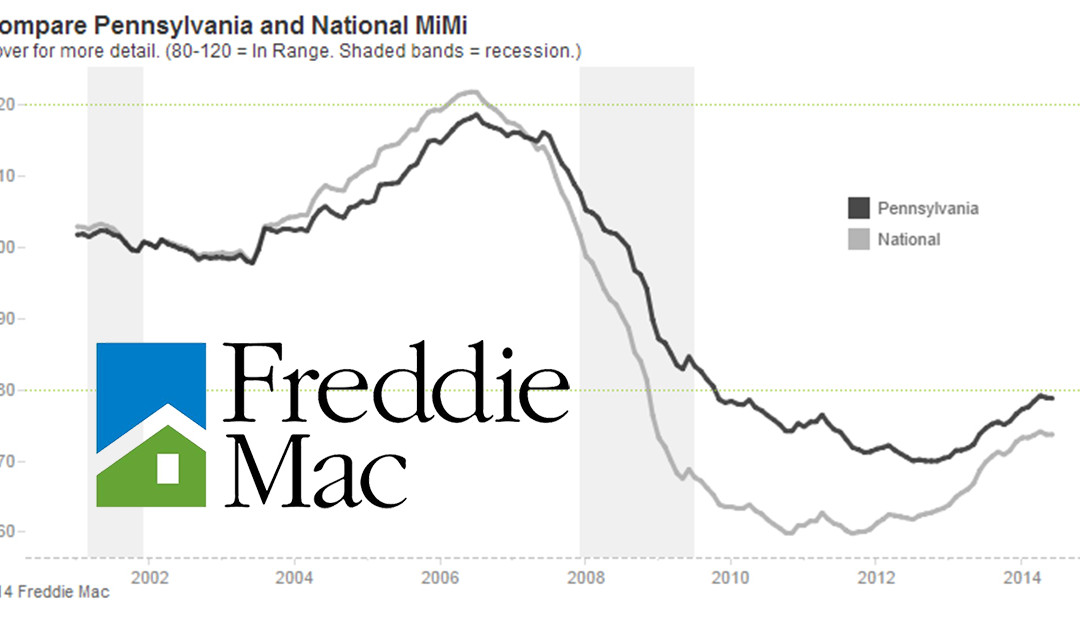

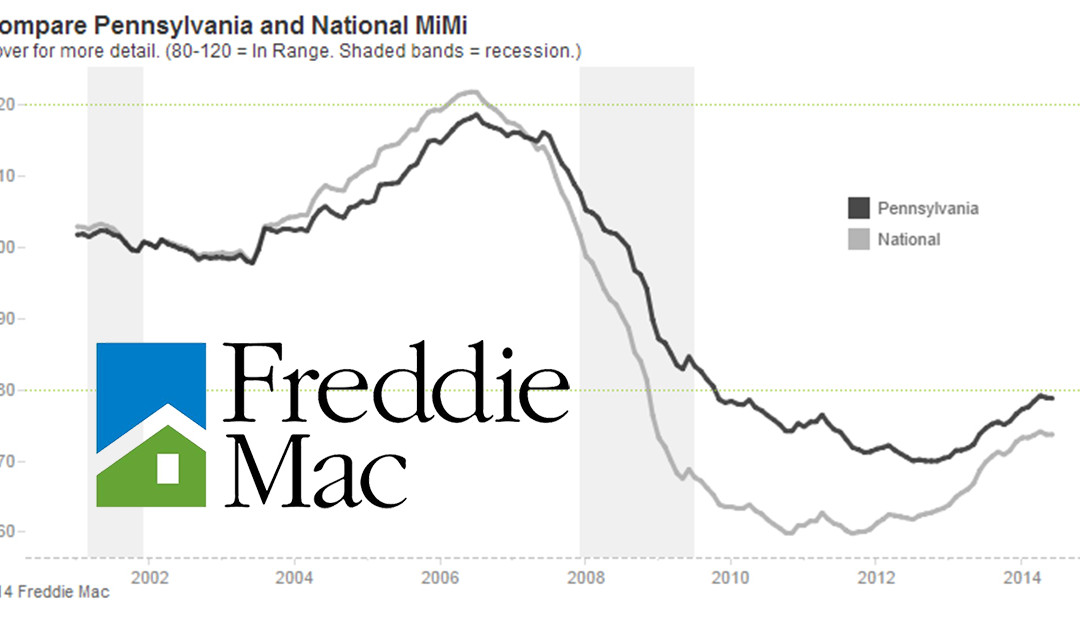

Freddie Mac’s Market Indicators Point Toward Continued Housing Improvement By Ryan Dosen Freddie Mac’s second quarter Multi-Indicator Market Index (MiMi) was released in late August. The report showed that the nation’s housing markets “continued to plod along in the second quarter of 2014, while most U.S. housing markets remain generally weak….” However, there were several signs that Pennsylvania’s real estate market is set to continue its climb from the early year doldrums. About Freddie Mac and the MiMi According to Wikipedia, the Federal Home Loan Mortgage Corporation, commonly known as “Freddie Mac”, was created in 1970 “to expand the secondary market for mortgages in the U.S. Along with other (government-sponsored enterprises), Freddie Mac buys mortgages on the secondary market, pools them, and sells them as a mortgage-backed security to investors on the open market.” As one of the most important cogs turning the wheels of our real estate market, Freddie Mac has to keep close tabs on housing. That’s where MiMi comes in. Freddie Mac states that its monthly MiMi “measures the stability of the nation’s housing market, as well as the housing markets of all 50 states … and the top 50 metro markets. MiMi combines proprietary Freddie Mac data with current local market data to assess where each single-family housing market is relative to its own long-term stable range by looking at home purchase applications, payment-to-income ratios (changes in home purchasing power based on house prices, mortgage rates and household income), proportion of on-time mortgage payments in each market, and the local employment picture.” MiMi composite scores can range from 0 to 200. Scores of...

by rtdosen | Aug 29, 2014 | Ryan Dosen Real Estate Articles

Total Cost Analysis and the Dreaded ARM By Ryan Dosen The adjustable rate mortgage (ARM) has taken its lumps over the past decade. Many of them well-deserved. However, there may be reason to consider taking another look at the ARM. The numbers behind the ARM may make more sense for your real estate and financial goals than you might anticipate. History of the ARM The ARM earned its less-than-sparkling reputation back in the devastating real estate collapse of the 2000s. During the real estate bubble, tons of people were saddling up for the ride with adjustable rate mortgages and negative amortization mortgages (mortgages that allowed you to avoid paying full principal and interest payments in the beginning by simply tacking the unpaid amounts on to the end of the mortgage—increasing your balance over time). The goal was to pay as little as possible out of your pocket in the beginning stages of loan payback. You weren’t going to hold on to the mortgage for 30 years. You were just taking advantage of a hot market. You’d pay 4 percent interest for a couple of years, while allowing the property values to increase by 20 percent. You’d sell relatively quickly, take a fast and easy profit, and be long gone before the rates would ever change. Or so you thought…. The low initial payments also allowed you to qualify for more house and bigger loans than normal. After all, your loan qualifications had been based upon the initial payments, not the payments you could be forced to make a few years down the road after the rates were recalculated. Of...

Recent Comments